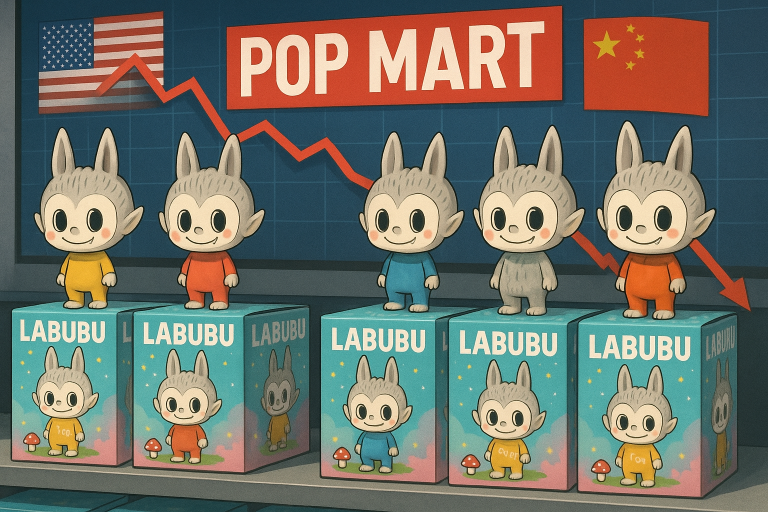

Shares of Pop Mart International Group, the toymaker behind the wildly popular Labubu doll, fell sharply in Hong Kong on Wednesday after analysts at Bernstein issued a stark warning that the company’s fourth-quarter results could disappoint.

The stock slid as much as 3.7%, making it one of the worst performers on the Hang Seng China Enterprises Index.

The note from Bernstein amplifies growing concerns that the frenzied demand for the company’s plush toys may be unsustainable, deepening a stock rout that has already wiped out $20 billion in market value.

Data points to a deeper slowdown

In a note dated November 11, Bernstein analysts cited a troubling trend across multiple independent data sources that points to a significant cooling of consumer interest.

“Multiple independent data sources indicate broad-based demand deterioration in both China and overseas markets during October, with weakness intensifying from peak levels in June,” the analysts, including Melinda Hu, wrote.

They argued that the slowdown is undeniable.

“The convergence of weakening transaction data, social media engagement, and search interest across independent sources paints a picture of fundamental demand deceleration difficult to dismiss as noise or channel shifts,” they added.

From market darling to mounting doubts

The warning from Bernstein hits at a vulnerable time for the Beijing-based firm. After a meteoric rise that made its stock the hottest trade in China’s consumer sector, Pop Mart has seen its fortunes reverse.

Concerns over its long-term sales outlook and widespread profit-taking have caused the stock to unravel, falling almost 40% since reaching a record high in late August.

This comes even as the company reported staggering third-quarter sales growth of as much as 250% year-on-year, highlighting how quickly sentiment can turn.

An outlier’s warning in a bullish market

Bernstein’s bearish stance makes it an outlier among the more than 40 brokerages that cover Pop Mart, with data compiled by Bloomberg showing it holds the sole “underperform” rating on the stock.

Despite this, the analysts are standing firm, concluding that the recent data is a clear red flag for the upcoming quarter.

“The magnitude and consistency of October declines across all metrics suggest Q4 results could disappoint expectations,” they wrote.

They maintained their price target of HK$225 for the stock, which, despite the recent plunge, is still up about 140% this year.

The post ‘Labubu’ craze cools: Pop Mart shares fall 3.7% on Bernstein’s negative outlook appeared first on Invezz