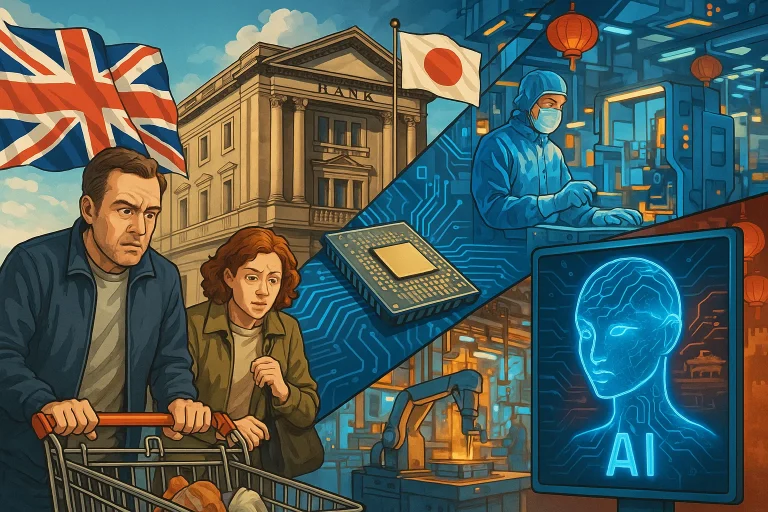

Global markets and tech headlines saw notable movements on Friday, from cautious consumer spending in the UK to steady monetary policy in Japan.

Asian chip suppliers are riding Nvidia’s AI investment wave, while China’s DeepSeek makes waves with a cost-effective AI breakthrough.

Across economics and technology, these developments highlight shifting trends and rising global competition.

UK shoppers pull back

The mood of UK shoppers seems to be shifting these days. With inflation still biting and whispers of more rate hikes on the horizon, people are pulling back on splurges and sticking to the essentials.

That is the takeaway from GfK’s latest survey, capturing a growing sense of unease across the country. Jobs aren’t feeling quite as secure, and wallets are tightening accordingly.

It’s the kind of cautious vibe that hints at slower retail days ahead, unless there’s some relief on prices or a boost to paychecks.

For now, Brits seem to be bracing for a tougher stretch, keeping a wary eye on their spending and what the next few months might bring. The feeling is clear: many are readying for rougher economic waters ahead.

BOJ to holds rates steady

Japan’s central bank is likely to keep its interest rates steady on Friday, sticking to its cautious approach amid growing concerns about global economic headwinds.

The Bank of Japan acknowledged risks from rising US tariffs and signs of a slowdown in key economies, but opted to maintain its ultra-loose monetary policy to support fragile domestic growth.

The move aligns with BOJ’s continued effort to boost inflation toward its 2% target, even as persistent global uncertainties linger.

Market watchers see this steady stance as a signal that Japan is bracing for economic risks without rocking the boat too much.

With tensions rising over trade and a wary outlook on the US economy, the BOJ’s decision hints that easy money is here to stay a bit longer.

For now, Japan’s policymakers seem focused on steadying the ship rather than sudden course changes as global risks loom large.

Nvidia boosts Asian suppliers

Asian suppliers tied to Intel’s chip business saw a sharp boost on Friday, lifted by hopes that Nvidia’s planned ramp-up in investments will trickle down through the regional supply chain.

The buzz around Nvidia’s spending spree has investors eyeing companies in Japan, South Korea, and Taiwan, betting that contract manufacturers and parts suppliers will be key beneficiaries.

With Nvidia doubling down on AI chip production, there’s growing optimism that this will spill over, helping breathe new life into the broader semiconductor ecosystem across Asia.

The sentiment is strong: as Nvidia ramps up, so does the market excitement around its suppliers.

This wave of enthusiasm is cementing the region’s role as a vital hub for chip innovation and manufacturing. Read full report here

DeepSeek sparks global AI buzz

China’s AI startup DeepSeek stunned the tech world by revealing it trained a top-tier AI model for just $294,000, an eye-popping bargain compared to Western counterparts.

This breakthrough showcases how China is rapidly closing the gap in AI innovation while cutting costs dramatically.

Using a mix of clever efficiency tricks and locally produced chips, DeepSeek’s achievement signals a new phase in the AI race, especially amid US tech restrictions.

It’s a bold statement that China’s homegrown AI firms can deliver cutting-edge models without breaking the bank. This cost-effective approach could reshape global AI dynamics and intensify competition. Read full report here

The post Morning Brief: UK spending slows, Nvidia lifts suppliers, DeepSeek cuts AI costs appeared first on Invezz